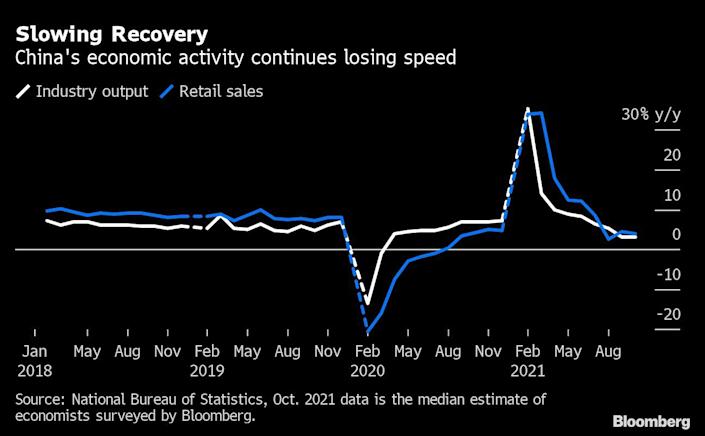

(Bloomberg) — China’s V-shaped economic rebound is fading faster than expected, catching analysts off guard and posing a new headwind for the already uneven global recovery.

Most Read from Bloomberg

That’s the emerging consensus as falling property prices, nervous consumers and a cooling manufacturing sector all point to slowing momentum in the world’s No. 2 economy. A surprisingly restrained policy response from Beijing has dampened hopes for more support, at least for now.

To put the turnaround in context, only months ago economists had banked on China cruising past an 8% growth rate for 2021 and carrying strong momentum into 2022. While this year’s expansion may yet hit the forecast range, the slowdown means Goldman Sachs Group Inc. and others warn China could see sub-5% growth next year.

For the world economy, the development threatens to strip away a key ballast of support. China’s hunger for raw materials and its quick reopening after the initial pandemic wave helped to fuel the global rebound too.

Data on Monday is expected to confirm the slowdown, with numbers for retail sales, fixed asset investment and industrial production all due.

An energy crunch over September and October coupled with elevated cost pressures is squeezing corporate profits and hitting factory output. Economists expect China’s industrial production to expand at the slowest pace since early 2020, at 3%. A leading sub-index in China’s PMI data that measures output also pointed to further softness, which was at its weakest since February 2020.

What Bloomberg Economics Says:

“China’s October activity readings are likely to show some resilience in industrial production and consumption, which probably started to stabilize following shocks from the power shortages. But fixed asset investment may have faced headwinds.”

–For full analysis, click here

Falling real-estate prices and credit-market turmoil for heavily indebted developers means fixed asset investment in the first 10 months of the year is expected to have slowed to 6.2% from 7.3% previously.

Although policy makers have started fine-tuning some policies and state media reports are fanning speculation of an easing in curbs, economists warn that the downturn in real estate — which accounts for up to 25% of output — could hurt the wider recovery.

China’s aggressive approach to controlling outbreaks of Covid-19 is weighing on consumers, especially for catering and off-line retail sales. Consumer confidence remains weak, and analysts expect retail sales growth to slow 3.8% in the month.

In other economic news due in the coming week, Hungarian policy makers may hike interest rates while their Turkish counterparts cut borrowing costs. Pivotal U.K. labor market data informing the BOE before its December decision will also be released.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

Asia

Elsewhere in Asia, Japan releases figures on Monday that are expected to show the recovery of the world’s third-largest economy slipping into reverse after hitting a summer virus wave and global supply-side glitches.

A particularly bad result could fuel even more stimulus from Prime Minister Fumio Kishida later in the week, when he decides on a package of economic measures. Trade and inflation numbers also come out from Japan this week.

Governor Philip Lowe will be among the Reserve Bank of Australia officials talking as markets and the central bank continue to differ on the trajectory of the economy Down Under.

Minutes from the RBA’s recent meeting may shed more light on the central bank’s decision to abruptly scrap its yield curve control in the face of market pressure and strengthening economic data. Meanwhile, Indonesia and the Philippines set interest rates on Thursday.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

U.S.

Retail sales are the headline for U.S. economic data releases in the coming week. Economists project a solid advance in the value of purchases in October, indicating a stronger pace of household spending after a soft third quarter.

The week’s reports also include data on industrial production and housing starts in October, and readings on November manufacturing activity in several Federal Reserve districts.

Eyes are also on the White House. President Joe Biden is expected to announce his choice for Fed chair before Thanksgiving, Nov. 25. He’s weighing whether to keep Jerome Powell in the job for a second term, or elevate Fed Governor Lael Brainard.

- For more, read Bloomberg Economics’ full Week Ahead for the U.S.

Europe, Middle East, Africa

U.K. economic reports, in particular from the labor market, may prove pivotal in the coming week. Bank of England Governor Andrew Bailey cited the workforce situation as a crucial element in why policy makers defied widespread expectations and held off raising interest rates this month.

“If you ask the question why haven’t we done it now, the answer is all to do really with the labor market,” Bailey told BBC Radio 4 on Nov. 5, explaining how more people than previously thought were on the U.K. furlough program when it ended in September.

Unemployment and wage data are due on Tuesday. On Wednesday, inflation may show an acceleration to 3.9%, the fastest in a decade. Retail sales on Friday will also provide clues on the resilience of consumers.

Meanwhile, in the euro zone, European Central Bank President Christine Lagarde will appear publicly at half a dozen events, providing multiple opportunities to guide investors before an all-important decision in December on the future of stimulus. Most prominent in her diary will be two hours of testimony to the European Parliament on Monday.

Central banks elsewhere will command attention as well. On Tuesday in Hungary, monetary officials may accelerate rate hikes after inflation surged more than forecast and regional counterparts embarked on aggressive tightening.

Iceland, the first country in Western Europe to raise interest rates since the pandemic struck, could deliver another hike on Wednesday. The same day, Norway’s central bank governor, Oystein Olsen, will speak on the economy just weeks before a decision that may also feature a rate increase.

In contrast with those countries and much of the Group of 20, Turkish officials are expected to continue the country’s unconventional monetary experiment on Thursday by slashing their policy rate for a third month.

The lira has borne the brunt of the fallout, dropping another 25% against the dollar this year, the biggest loss among major currencies worldwide.

The same day, the South African Monetary Policy Committee’s vote on its benchmark interest-rate decision is likely to be a close call as it weighs anemic economic growth against inflation edging closer to the top of its 3% to 6% target range.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

Peru’s statistics agency posts October labor market figures for the country’s capital, Lima, on Monday. The unemployment rate has risen marginally, and underemployment has edged up since June as the economy rebounds.

Brazil’s September economic activity report out Tuesday may again underscore the fragile state of its recovery as confidence wanes and headwinds mount, with a negative third quarter a distinct possibility.

Three of the region’s big economies post third-quarter output reports. Analysts expect Colombia’s data on Tuesday to show a sharp quarterly rebound and a year-on-year reading of better than 10%.

The next day, the hottest of Latin America’s bigger economies, Chile, is expected to at least maintain the torrid pace set in the second-quarter as billions of dollars in stimulus measures propel the expansion of one of the region’s richest nations.

Rounding out the week, Peru’s quarterly GDP figures are likely to trail those of its Andean peers but still put the economy on track to lead Latin America in growth for 2021. Central bank chief Julio Velarde on Thursday said the economy may grow 13.2% in 2021.