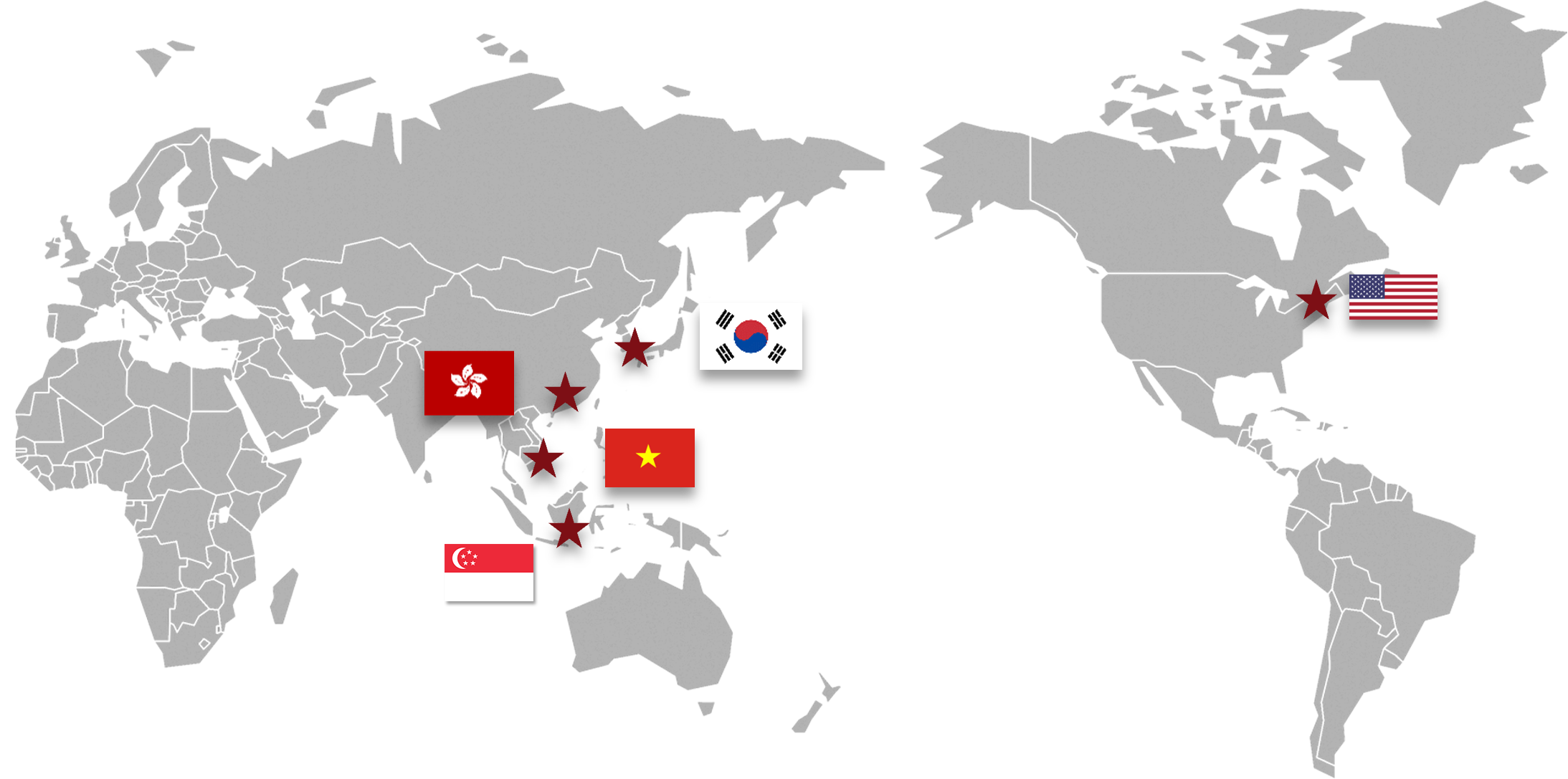

Major coverage markets: US, Korea, Vietnam, Singapore, and Hong Kong

Tommy H. Lee has over 20 years of capital markets, investment banking, private equity,

and financial services experience focusing on U.S. and Asia emerging growth, small cap,

and middle market companies. Tommy has negotiated, structured and closed various types

of financing transactions including retail and institutional private placements, venture

capital, mezzanine financing, senior debt financing, initial & secondary public

offerings, LBOs, MBOs and cross boarder M&A. His transactional experience spans a broad

range of industries having raised in excess of $2.0 Billion USD. Additionally, he has

been involved in numerous M&A assignments and advisory services for both private and

public companies in the U.S. and Asia.

Tommy started his career on Wall Street with Oppenheimer and JP Morgan Chase where he

served as Vice President of Investments. As Vice President, he has advised, customized

and managed portfolios for HNWIs and Institutional Clients. In addition to his

investment advisor background, Tommy, has successfully performed deal origination for

numerous strategic, private equity, public, and private companies. He has advised

clients on strategic partnerships, cross-border M&A, capital raise (equity, debt, and

mezzanine financing). As a direct result of his transactional experience, Tommy has an

extensive network of relationships with investment banks, private equity investors, venture capital funds,

hedge funds, mezzanine funds, and asset-based lenders.

Tommy spends most of his time in Ho Chi Minh City, Vietnam, actively serving on various boards

while advising Chairmen and Executives of both private and public companies on capital raising,

capital structure, restructuring, strategic and financial partnerships, and cross-border M&A.